Introduction

We need to rethink everything we know about community.

It isn’t just a fancy campaign that drives clicks and engagement. It’s the reality of the community association industry as we know it. When CINC Systems launched the 2023 State of the Industry Survey, the goal was to fully understand the needs of the homeowner, and the consequences on the management company if those needs go unmet.

When we reached out to homeowners, board members, and management company employees to take our survey, we chose to seek responses from several different outlets. We reached out to esteemed industry professionals through email and local outreach. But we also reached out to HOA and COA members via Nextdoor, Reddit, and Facebook. We asked homeowners to be honest on what they would want to say to their management companies. The results we have to share may be at times challenging to absorb. But we believe that those who take the time to understand these findings and apply new learnings to their business will prosper.

In reviewing the 2023 State of the Industry Report, one will quickly realize that “the way we’ve always done things” won’t work anymore. It’s time to reexamine the way we communicate with board members, the way we motivate community managers, and the way we run day-to-day tasks. It is time to Rethink Community.

The Purpose of the Survey

CINC Systems is proud to bring to you the second annual State of the Industry Report. Taking the metaphorical pulse of a thriving, but niche, industry is an important part of helping that industry find new ways to achieve success. In conducting this thorough report, we are able to provide valuable insight to esteemed industry professionals and identify opportunities to support our clients and grow our product offerings.

The State of the Industry Report was developed by a marketing and research agency familiar with community association management. The survey was distributed at large, and results were compiled by an outside data analyst.

While CINC organized this survey, it’s important to note that it was open and distributed to the industry at large. For the most accurate results, it was important to us that we include answers and opinions from as wide a variety of respondents as possible. From members of highly reputable institutions to social media channels, everyone actively part of a professionally managed community were welcome to participate.

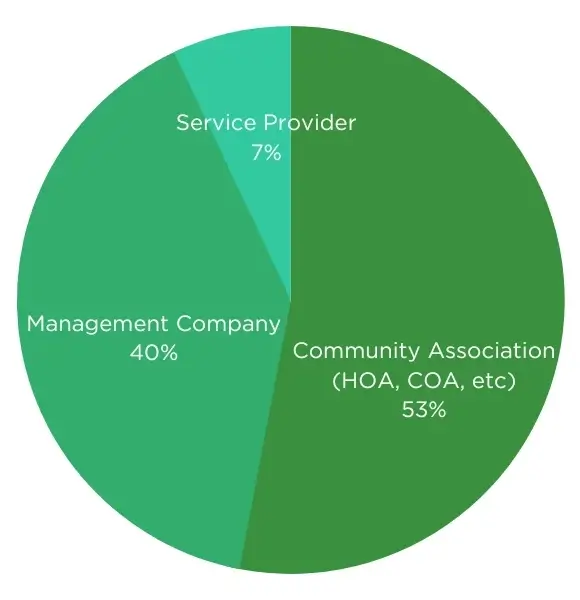

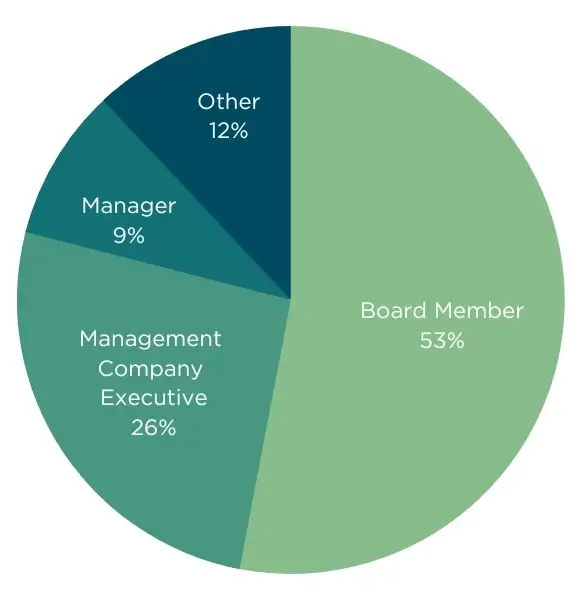

This survey consists of responses from management company executives, individual community association managers, community association board members, and service providers to communities and management companies. The results show a thoroughly detailed array of concerns and expectations industry professionals have throughout the United States.

It is our hope that these responses and our analyses of them can provide communities and management companies with benchmarks to show readers that they are not alone and offer a guide to help navigate their concerns and tackle them with the right tools and support systems.

How We Structured the Questions

We asked every respondent to answer the same question: “What is the biggest issue facing the community association industry?” After asking that question, we diverged the questions between community associations and management companies, asking questions that were relevant to each group, but may not correlate directly between the groups.

Community Associations

These primarily included board members and individual managers (on-site or executive managers). We asked this group questions related to the staffing, technology and management of their individual community associations as well as their overall satisfaction with their management company. Individual managers for self-managed communities were part of this sector, while managers employed at management companies were segmented into a different category. We did this so we could fully understand the needs of a Community/Property Manager employed at management companies to provide insightful information to management company executives.

Management Companies

This group consisted of management company executives and assorted other management company employees. We asked this group to answer questions related to the management company itself so that we could understand threats and goals, service offerings, staffing and budgeting benchmarks, and customer satisfaction.

Community/Property Managers

This group of employees, who are also part of management companies, received a separate set of questions pertaining to their skillset and potential growth opportunities.

Industry Vendors/Other

Any respondent that did not fit into the community association/management company structure was not included in those segments. We asked these respondents general industry questions only.

Respondent Breakdown

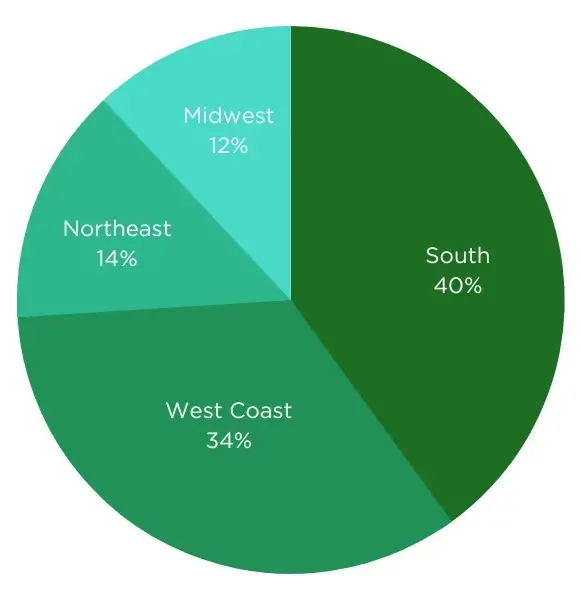

Of the 236 respondents for the 2023 State of the Industry survey, the majority were community associations, followed by management companies and management company service providers. 40 percent of the respondents were located in the Southern region, 34 percent in the West coast, 14 percent in the Northeast and 12 percent in the Midwest.

Summary of Key Findings

- It’s All About the Manager. Board satisfaction with their management company is tremendously reliant on the quality of the Community Manager assigned to their property. But as manager burnout is one of the top concerns of board members, they are clearly not seeing enough of their manager on site, nor are they receiving enough communication. Does this mean executives need to reevaluate their management team, or the tools that they provide to their management team?

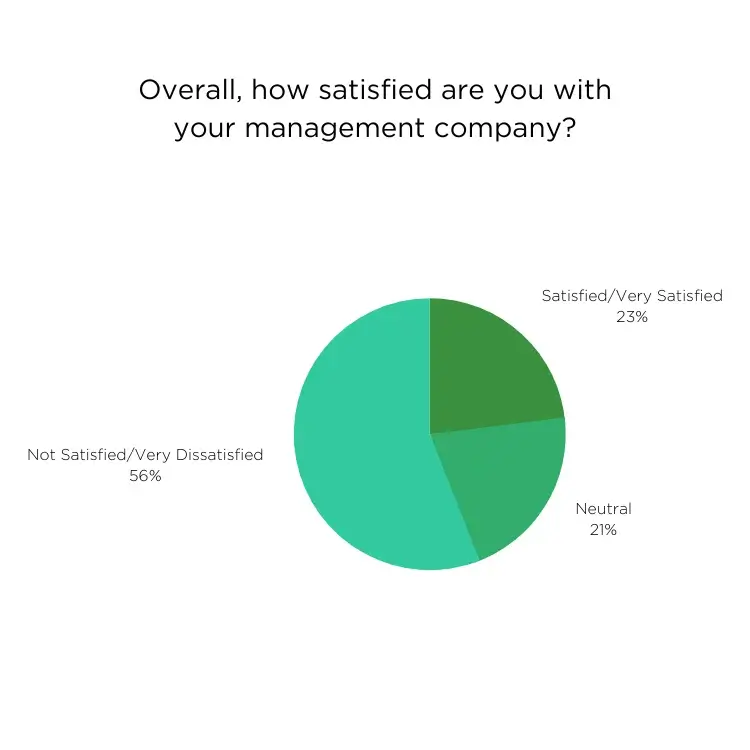

- Boards Aren’t Happy. While other studies show relative satisfaction towards management companies, our report shows an overall dissatisfaction. This is also made clear with the level of client churn management companies are experiencing. If management companies lose just as many clients as they gain year-to-year, is growth even possible?

- A Lack of Education is Cause for Concern. There is a clear need to provide board members more education to properly make effective change within their community. Volunteer board members don’t feel properly equipped to support their communities, and it’s causing a lack of engagement and increased client frustration. Management companies who provide sufficient homeowner and board education will reap the rewards.

- Reserves are Running Low. Both management companies and community associations are concerned with reserves funding, and many communities have failed to reevaluate their reserves. This inaction can lead to dire consequences, especially in a time where costs continue to rise.

- Investments Aren’t Adding Up. Management executives are focused on portfolio growth and profitability and plan to invest in their management staff in order to grow. But based on what we hear from the managers themselves, they aren’t planning to invest in the right areas of the business. If there’s misalignment between what executives are providing to managers and what managers actually want from their executives, what will happen to a company’s bottom line?

Industry Pulse

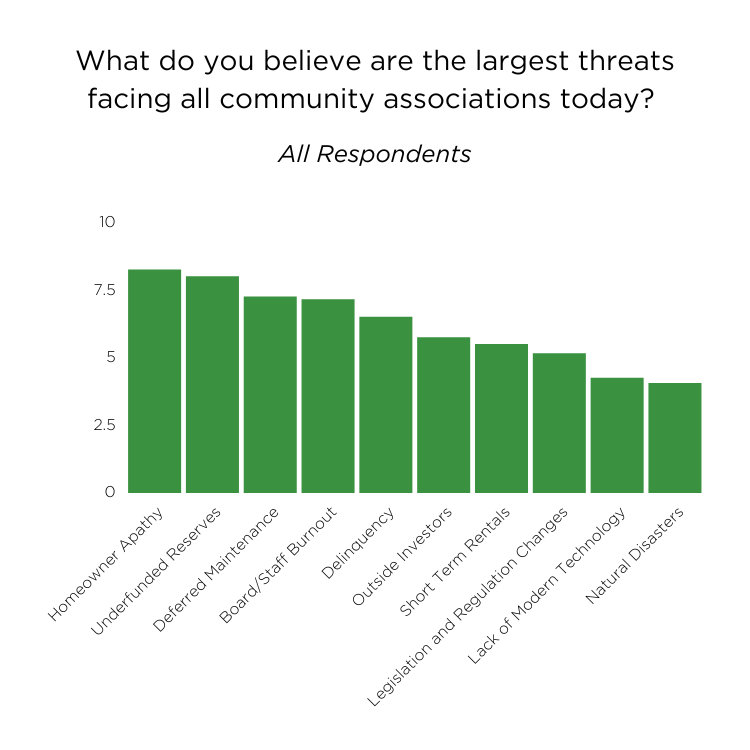

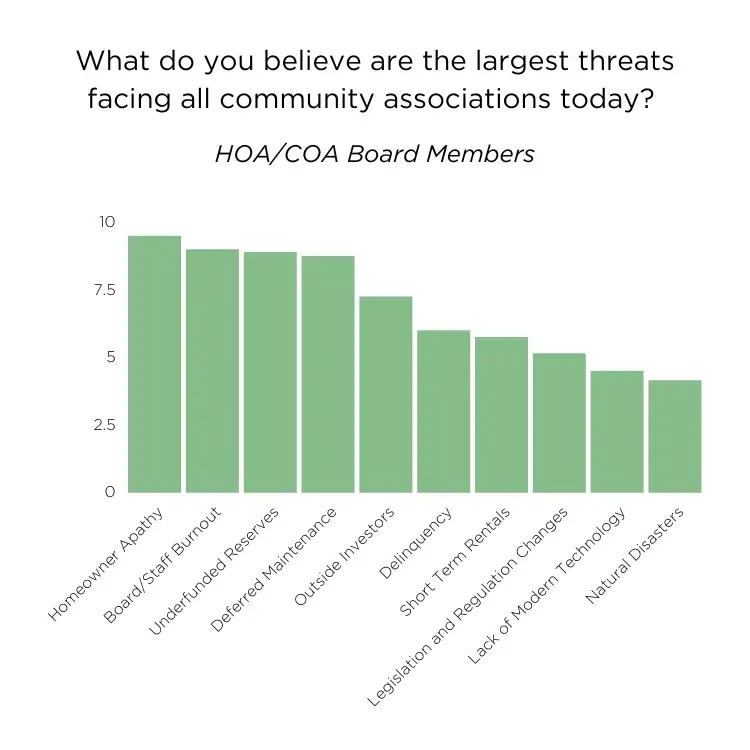

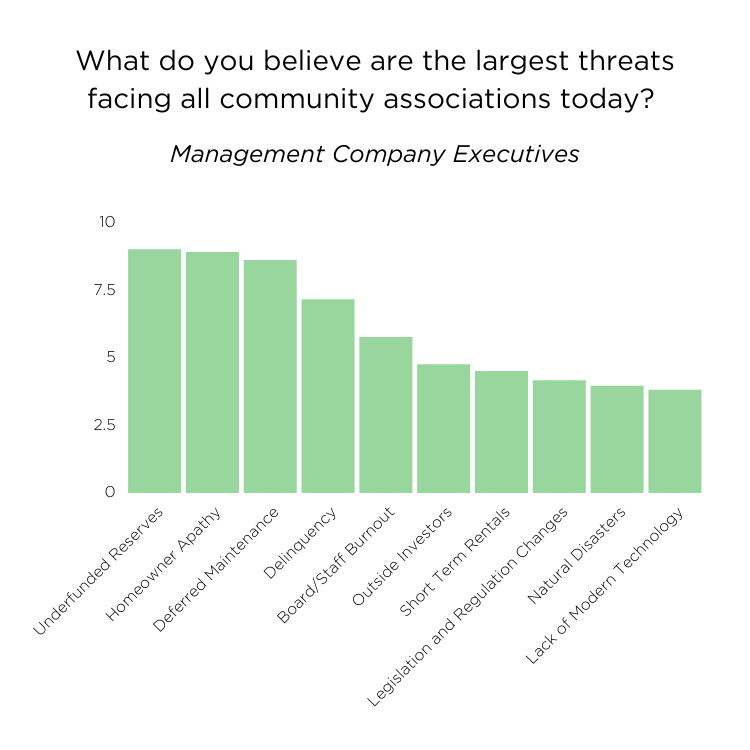

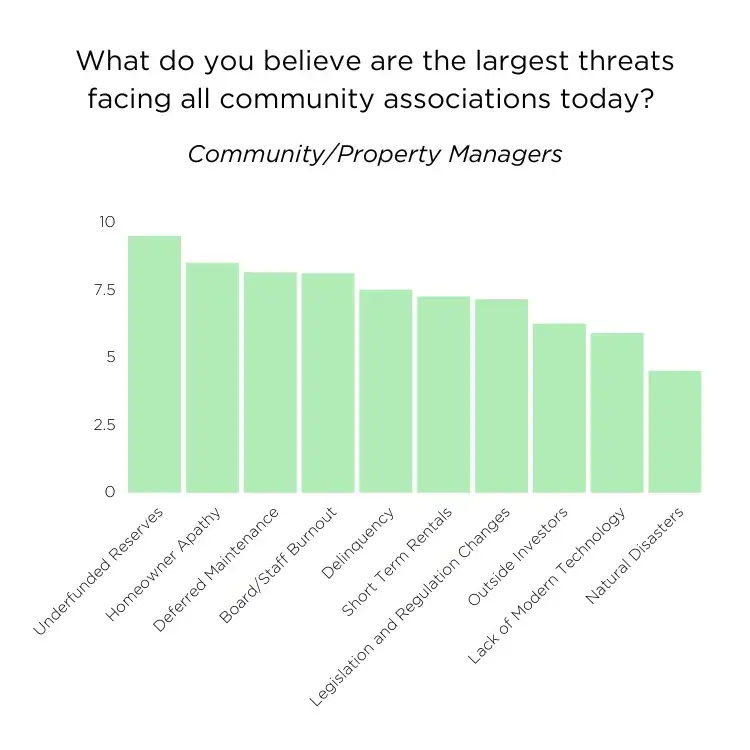

The first question that we asked all respondents for our State of the Industry Report was, What do you believe are the largest threats facing all community associations today? We ranked the results with 10 being the highest ranking threat and 1 being the lowest ranking threat. The below stats showcase the weighted average of total responses.

Similar to our 2022 report, Homeowner Apathy was the top ranked threat facing community associations. High homeowner apathy, or a lack of homeowner engagement, prevents growth on the boards and hinders diversity of thought. It may impact the board’s ability to make quorum and sour relations between the board and residents.

In addition to homeowner apathy being an overwhelming concern, underfunded reserves came in as a close second, followed by deferred maintenance. These concerns surrounding aging infrastructure have been top of mind since the Surfside Condo collapse in 2021 and the subsequent legislation that followed.

The next threat noted by respondents related to board and staff burnout. Interestingly, this concern was ranked higher by board members and community managers than management company executives. Overwhelmed community managers and undereducated board members may be contributing to stunted growth opportunities across the industry.

Delinquency, which directly impacts a community’s budget, is a growing concern. Many respondents questioned the ability for their homeowners to continue making thoughtful and timely payments during a pending recession.

Investment homes owned by outside investors (foreign or domestic) for use as short term rentals remain a top concern in 2023 as it did in 2022. For an industry in which homeowner apathy is critical to community improvement, it’s important for communities to have residents living and working within the actual place of residence.

Finally, while legislation, lack of modern technology, and natural disasters were ranked low in concern, these categories easily feed into issues pertaining to homeowner apathy, aging infrastructure, and staffing issues. Homeowner apathy can be resolved by modern technology, but it seems that respondents weren’t making the connection.

Notable Responses

We asked our respondents if there were any emerging concerns we may have not considered in the categories we had listed. The responses we received were quite unfiltered, and at some points, disturbing. Trending topics include:

- Violence and Safety Concerns. There was an overwhelming number of concerns related to criminal activities, violence, and homeowner hostility. While an increase in aggressive behavior has been a growing concern since post-pandemic anxieties ensued, the numerous responses relating to actual crime and even shootings were alarming. While we do not have sufficient data to know if these concerns are real or perceived, nor do we necessarily have the expertise to discuss such sensitive topics, we do take note in this feeling within the communities serviced by associations and will continue to research.

- Qualification and Education. Many respondents expressed concern over the level of education received by board members. By not understanding the basics behind running an association, as well as emerging legislation, managers and boards aren’t able to properly service and engage their communities. Many respondents also noted that because their management companies have been growing so quickly during a tight labor market, they’ve been unable to hire qualified staff to accommodate their communities.

- Perception. The negative perception associated with homeowners associations impacts overall homeowner apathy. As one respondent noted, “To most Americans, anything and everything to do with an HOA is a negative. Education is needed to make people in general understand that local governments are forcing communities into a quasi-municipal position with responsibilities and obligations similar to those of cities and counties in many cases.”

Key Takeaways

Homeowner Engagement is Critical

Arguably, one could make the case that many of the top issues, such as delinquencies, deferred maintenance and underfunded reserves, even short-term rentals and outside investors can all be tied back to a single root issue – homeowner apathy. When the homeowners don’t care, the community as a whole suffers. Boards of directors, management companies and even industry vendors should all be seeking ways to put an end to homeowner apathy to turn these problems around.

Aging Infrastructure Calls for Threat Assessment

Community associations overall need to consider a better method of threat assessment to avoid rising maintenance costs and the potential impact of deferred maintenance. Keeping assessments low sounds great in the short term, but the cost may be paid in property damage and/or human lives in the future. Properly funding reserves and following best practices for preventive maintenance should be a top priority for every community association.

Staff Burnout Needs to be Reprioritized

Management company executives should be alarmed that their clients are more concerned with staff burnout than they are. Perhaps they aren’t recognizing the level of burnout that board members recognize in their management team, or perhaps they aren’t sure how to go about hiring more qualified managers in a labor market where qualified prospects for a niche industry are far and few in between.

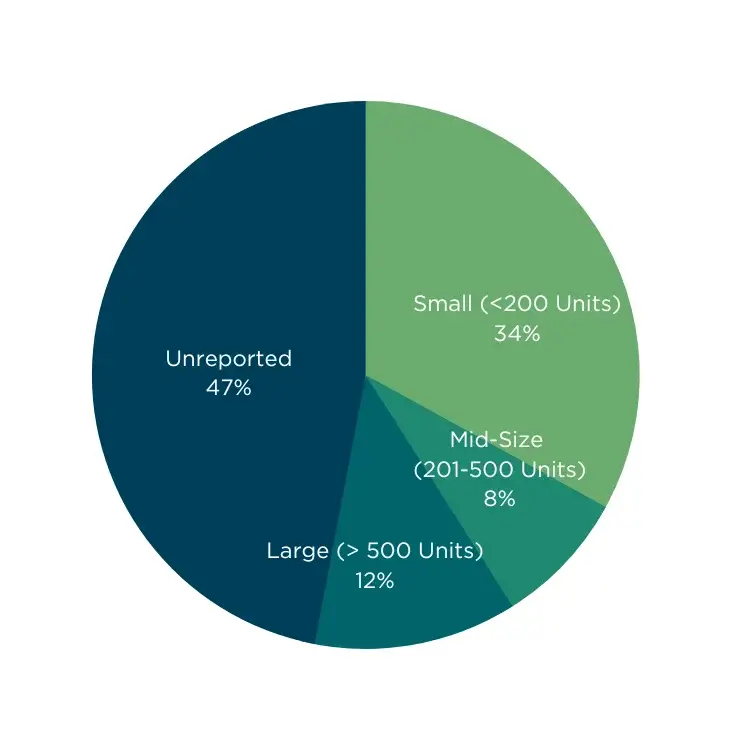

Community Associations

Community associations responded from across the country and in a wide range of sizes. We segmented associations by region of the country and based on the number of units they reported:

- Small Communities – fewer than 200 units

- Mid-size Communities – 200 to 500 units

- Large communities – more than 500 units

A large segment of community respondents opted not to share their community size.

Reserves Funding

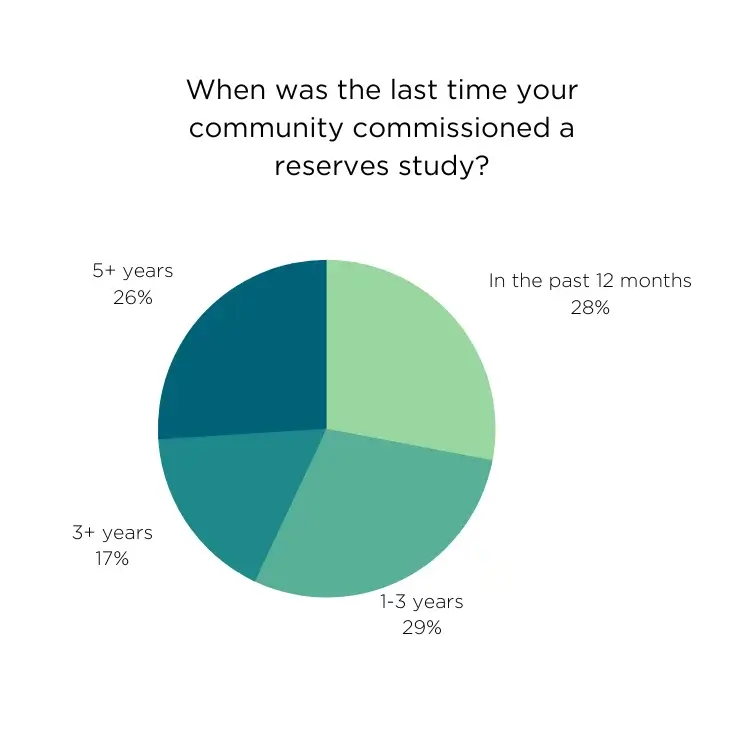

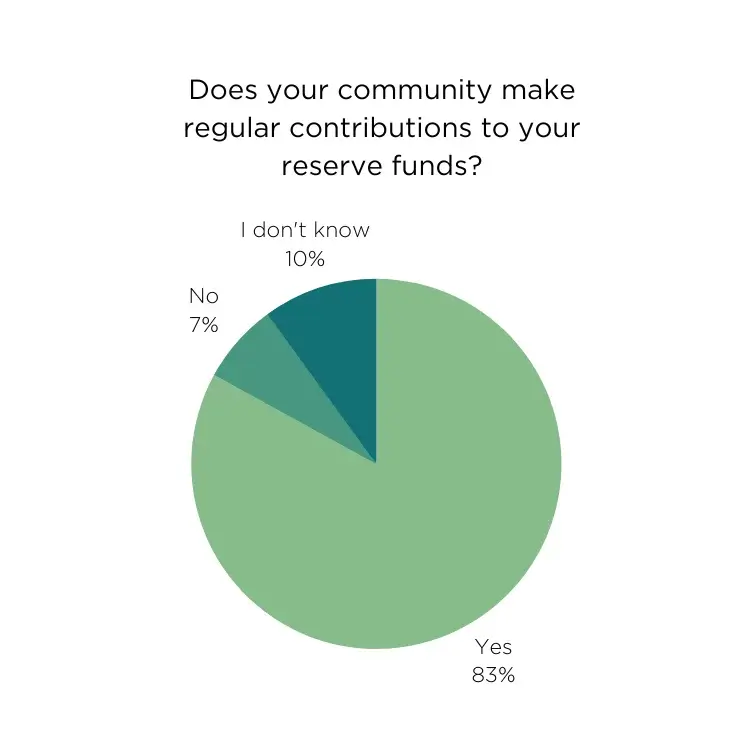

As it is apparent in the Industry Pulse, inadequate reserve funds are a top concern across all fields within the community association management industry. This should come as no surprise when reviewing our data; less than a third of all community associations surveyed have commissioned a reserves study within the past year, and 42 percent have not completed one in the past three to five years. This is alarming, considering that associations are using reserves funds as their primary method to fund capital improvements.

Emergency Preparedness

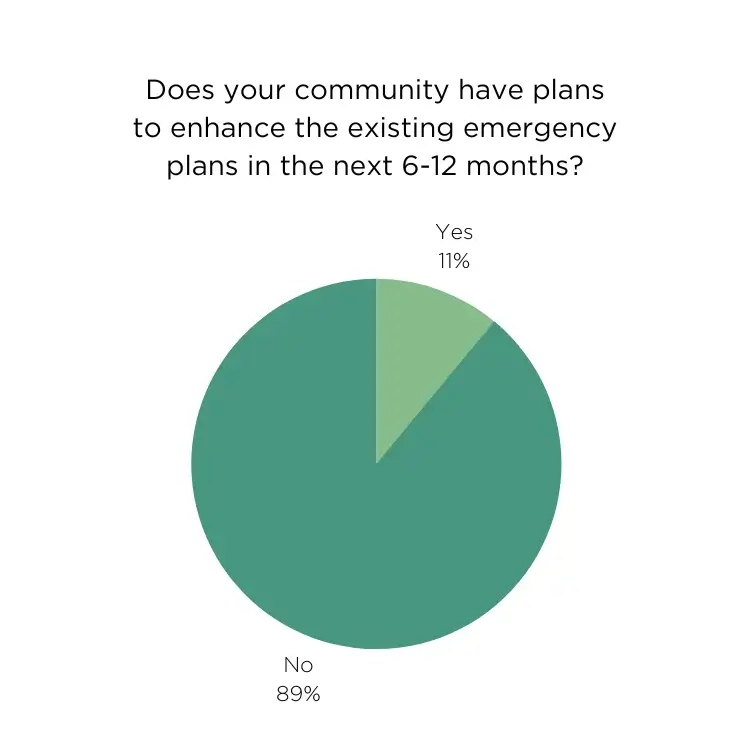

Emergency preparedness was not cited as a top concern within the industry, and 89 percent of respondents do not have a plan to enhance their existing emergency plans in the next 6-12 months. This lack of concern is surprising given its drop since in the 2022 Report. While it’s challenging to speculate about the reasons behind the drop, concerns over inflation and rising homeowner tensions may simply be taking the reins.

Management Company Communications

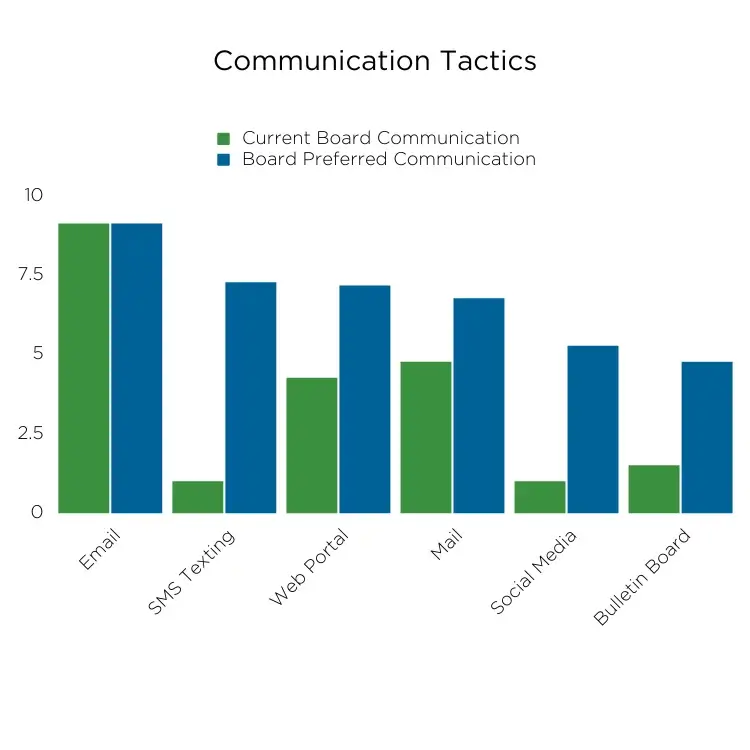

Communication between the association and the management company is a long-time concern within the industry. We asked community associations how they receive communications currently from their management company and how they would like to receive communications in the future, with the option to select all categories. We then created a weighted average for each category. It’s important to note here that this question is referring to general communication as opposed to specific product offerings through a management company.

Our data shows that overall, associations would greatly benefit from more communication across multiple different channels. Email is the only channel that associations feel are adequately used by their management company. Associations would mostly prefer to receive more communication via SMS/text, web portals, and mail.

Management Company Ratings

Overall, 56 percent of respondents were either not satisfied or completely dissatisfied with their current management company.

We asked board members, If you could tell your management company one thing they’re doing right, what would you say? Overwhelmingly, trending answers pertained to physical attendance at board meetings, a high performing community manager, responsiveness, and mobile apps for homeowners.

We also asked board members, When you are shopping for a management company, what three factors are the most important to you? The prevalent themes were:

- Communication. Transparency, quick response time, and a strong reputation

- Financials. Accurate reporting structures, thoroughness, maintenance upkeep

- Cost. Keeping fees low for the association

Notable Reponses:

- “Be more polite to homeowners”

- “We need communication. We need meetings. We need finance reports. Anything we pay for, we should be allowed access to the info on it.”

- “Participate if you want to effect change.”

- “It is all about the community manager for the property – the company they work for is much less important: I would tell them to value their human resources more.”

Key Takeaways

Some of the important takeaways for community associations:

Failure to Plan

In many ways, what we’ve discovered is that community associations feel challenged by a large-scale lack of preparedness. Whether that’s a staffing deficiency, uncooperative or uncommunicative managers, underfunded reserves, or insufficient emergency preparedness, board members should seek out new methods of support, and make a plan to address these issues.

Communication Breakdown

There’s a clear discrepancy between the board and the management company when it comes to communication. Management companies need to increase their digital communication strategies in order to achieve better satisfaction and transparency. Many of these communication tactics can be easily automated, and web portals need to be better utilized.

Just Be Present

So long as the community manager is perceived as open and available by the board and subsequent homeowners, management companies should expect to experience strong client satisfaction. Management company executives should heavily evaluate the day-to-day tasks of their management staff. They should also consider what they can do to provide more time for managers to be face-to-face with clients.

Management Companies

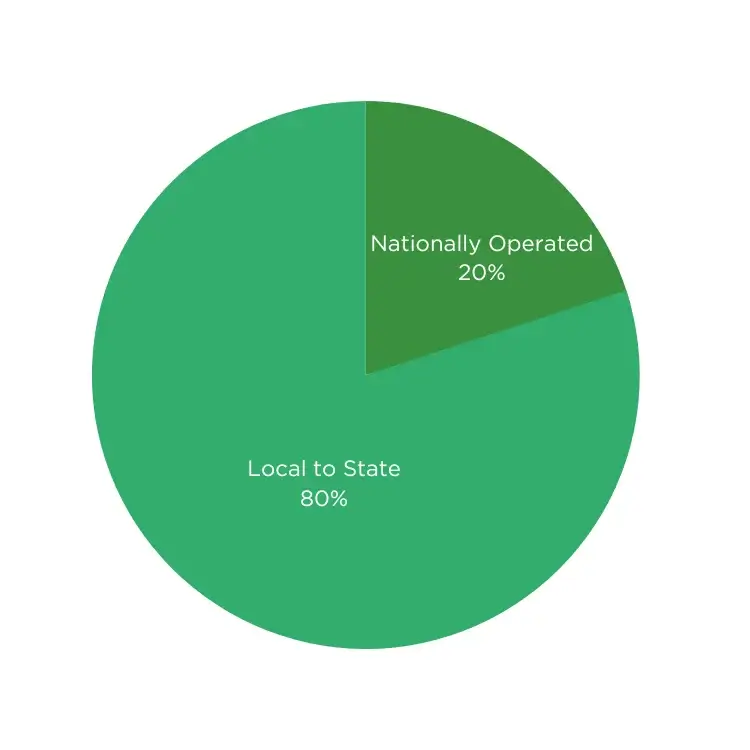

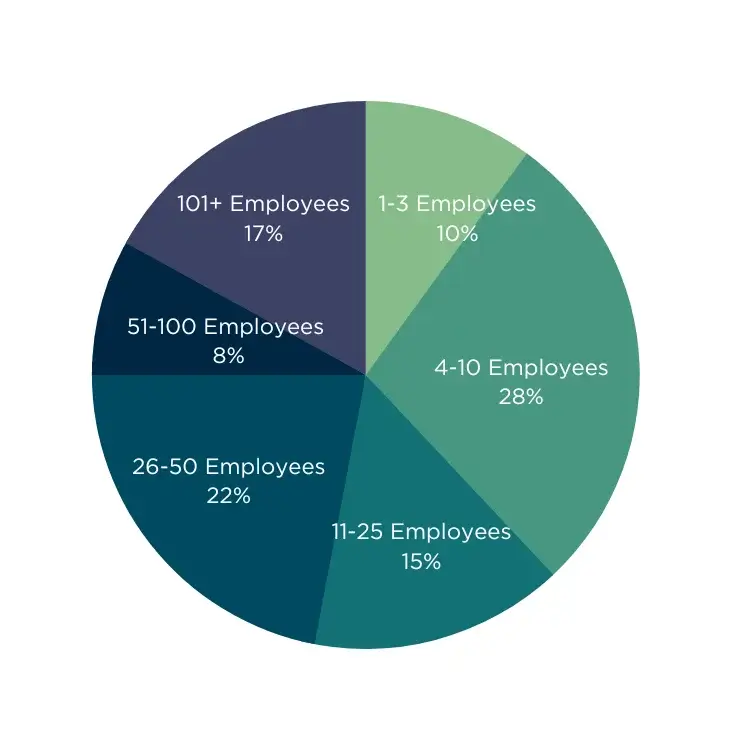

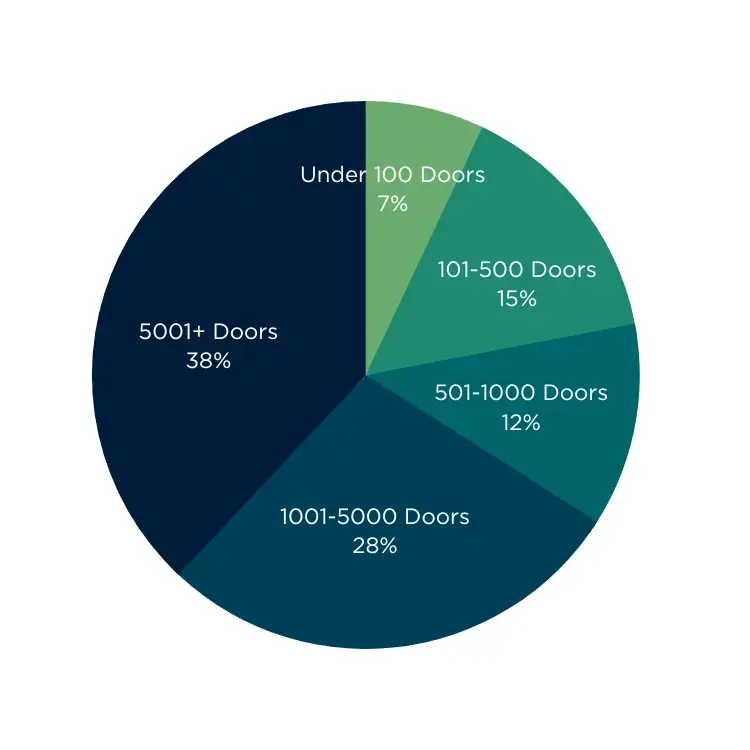

The majority of management companies surveyed for the 2023 State of the Industry report comprised of businesses local to their state in the mid-to-large size range. The majority of the companies surveyed employ fewer than 50 employees and have over 1000 doors.

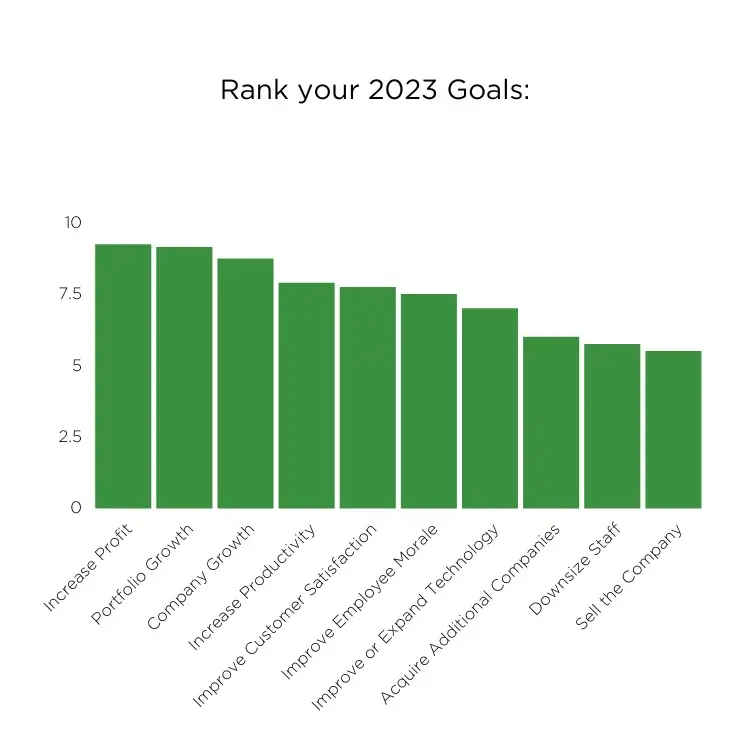

Management Goals

Despite the challenging and uncertain economic landscape, management companies are planning for growth: the top three goals in 2023 for management executives are to increase profit, increase portfolio count, and overall company growth. Following company growth, productivity, customer satisfaction, and employee morale were also ranked high.

While it isn’t surprising that executives are focused on growth, what is surprising are the individual responses sharing what executives are doing to reach their goals. This is because, traditionally speaking, the methods they plan to employ would increase cost.

Notable responses include:

- Increased training and employee incentives

- Increase mental health of staff members

- Upgrade technology

- Looking for ways in which technology can improve employee productivity and morale

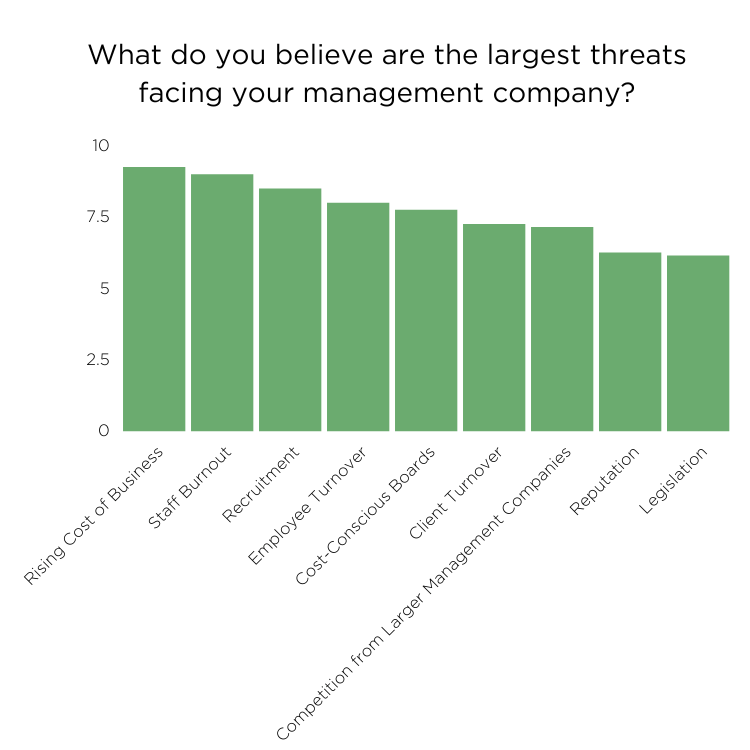

Management Threats

The core issues that management executives see as a deterrent against their goals relate to current environmental factors: rising cost of business, staff burnout, and recruitment.

The rise in inflation and incoming recession are certainly affecting concerns for the cost of handling business. But also concerning is the inability to hire quality talent that can handle both the workload and the customer tensions that managers commonly experience.

It seems that executives are struggling to understand the balance between keeping costs low and keeping morale high. As one respondent put it, “As a small company where I manage too, I’m working on trying to figure out the real cost per staff so as to make better choices in community retention and growth.”

The Labor Market

Overload and burnout are frequent topics of discussion in the community association industry. In fact, staff burnout ranked 4th among our survey responders as the biggest issue facing our industry today.

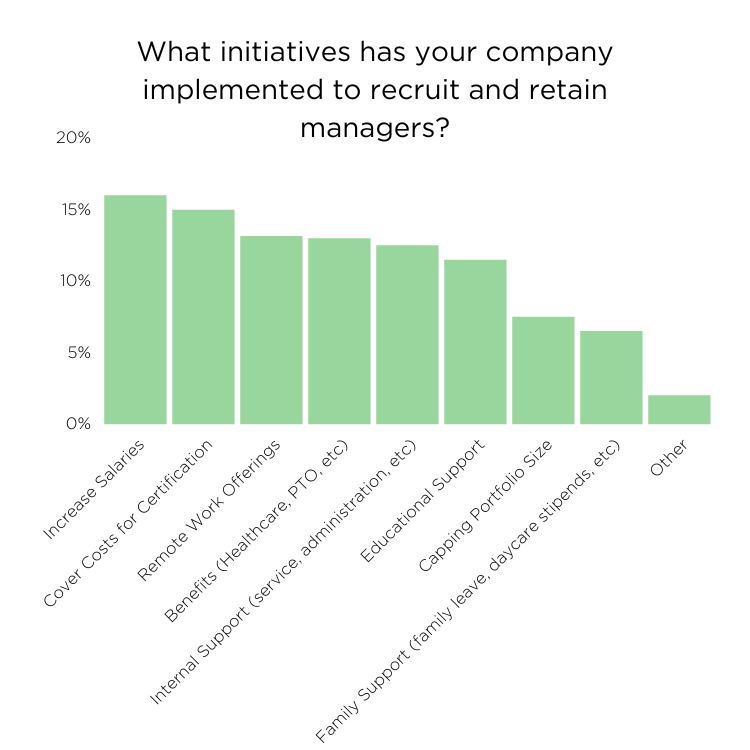

We wanted to understand what management executives are doing to handle the tight labor market and better support their employees. When it comes to recruitment and retention, 16 percent of executives surveyed have increased management salaries. Other popular initiatives to recruit and retain talent include covering certification expenses, offering remote work flexibility, and improving benefit offerings.

It doesn’t seem that the tactics applied are working. When we asked how companies are handling the tight labor market, 34 percent of respondents stated that they’re still struggling to find talent – this includes respondents who increased management salaries.

So our industry faces a conundrum. Costs are at an all-time high and a pending recession is sparking anxiety among business owners nationwide, yet the labor market is tight and owners are still struggling to find quality talent. Increased salaries, certification opportunities, and healthcare benefits are all great considerations. But more needs to happen to bring better talent to community association management.

The Community Manager

We’ve discussed at length what board members think about community managers and what management executives are doing to support community managers. Now it’s time to hear from the community managers themselves. When executives review the following results, they will likely be surprised to note that the strategies they have implemented to improve employee retention and morale are the exact opposite of what managers state they need to grow in their career.

Despite the alarming concern that boards are sharing over the level of burnout management staff is experiencing, managers are not responding with a strong level of burnout. In fact, the vast majority of managers responded that they feel low levels of burnout.

So why is there such a discrepancy? It could be that managers are used to the hustle of their role and boards are not, or it could be that managers are losing sight into the lack of communication they are providing to their clientele. Regardless, this misalignment is cause for concern.

When asked about their skillset, community managers note that communication and face-to-face engagement are their strongest skillset. Board consultation and vendor management follow next, with skills pertaining to project administration and general property upkeep (inspections, reporting, and event coordination) are their lowest skillsets.

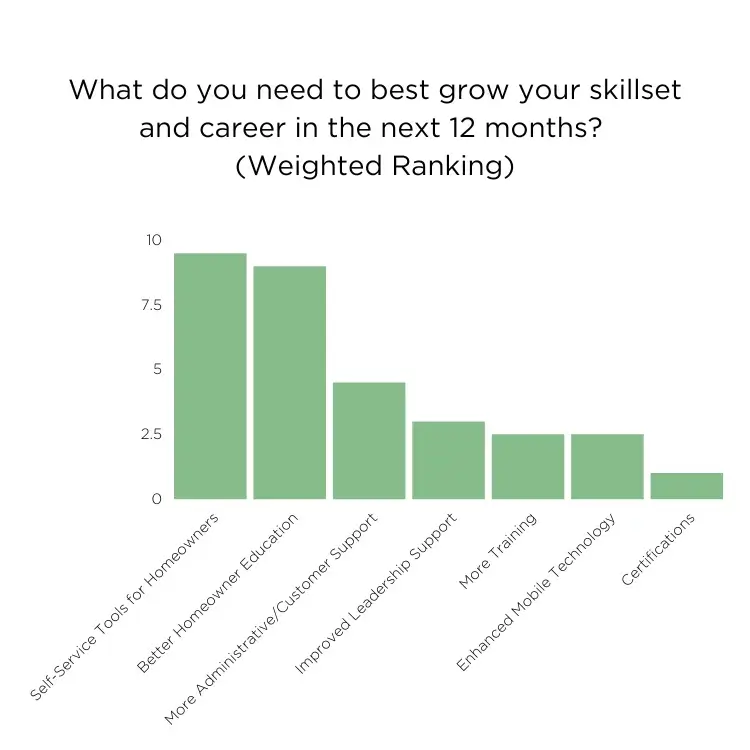

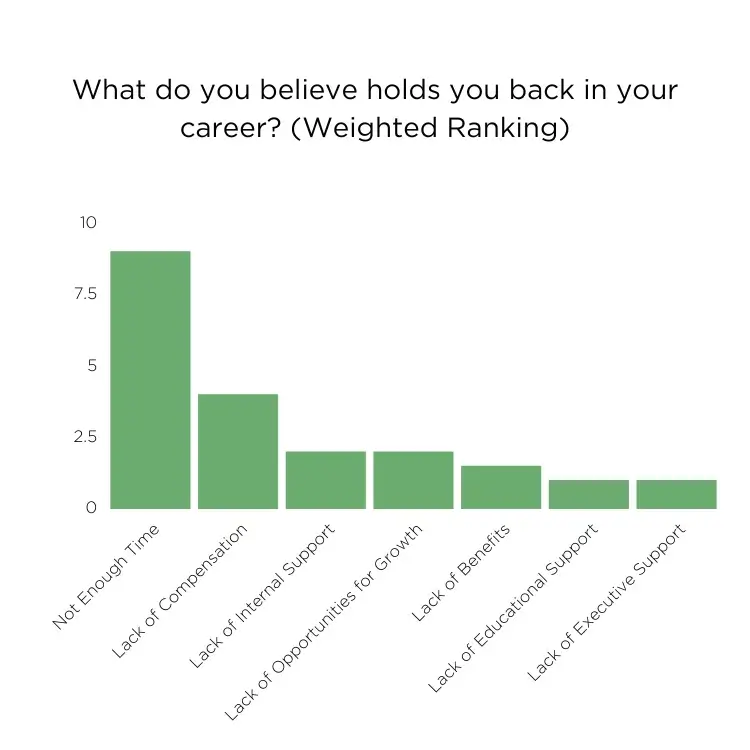

When asked what holds them back in their career, managers noted time as their biggest career deterrent, followed by compensation and a lack of internal support. It should be noted that not enough time ranks considerably higher than any other category. And most surprisingly, when we asked community managers what they need the most to grow in their career, their top career need was self-service tools for homeowners. Second on the list was better homeowner education, followed by more administrative support. Certification, though highly ranked by executives as one of their tools to grow a manager’s career, was the least of their concerns. Managers also didn’t rank mobile technology high, though they ranked self-service tools for homeowners high. This shows a knowledge gap: some of the most powerful tools to self-service homeowners are mobile tools, and it seems as though managers are not aware of the mobile efficiencies available to their clients.

The theme here is obvious: if you invest in the homeowner, you invest in the community manager.

Client Turnover

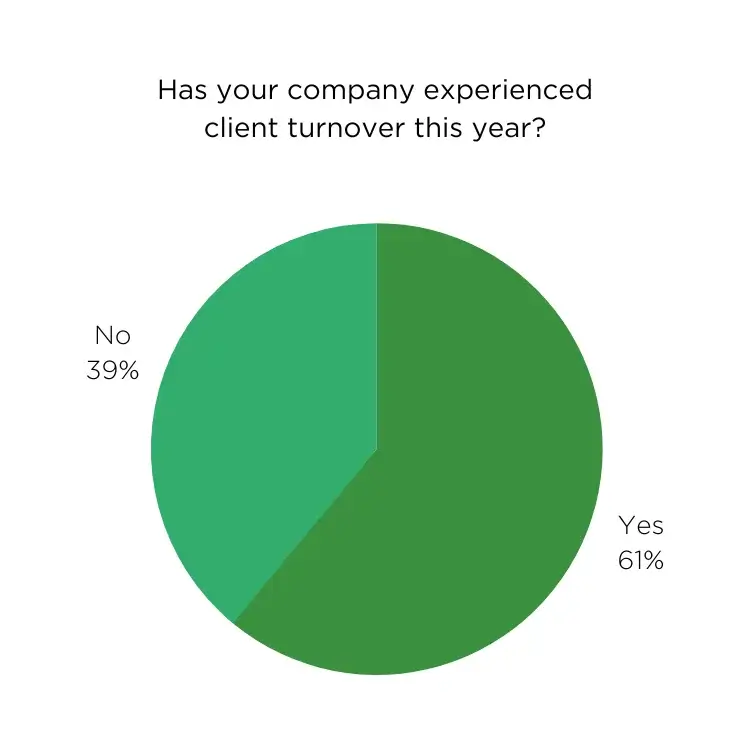

Portfolio growth was the second highest ranking goal for 2023 by management executives, and client turnover was the sixth ranked threat facing management companies for the year. But based on results in client churn from 2022, management executives may need to exercise more concern.

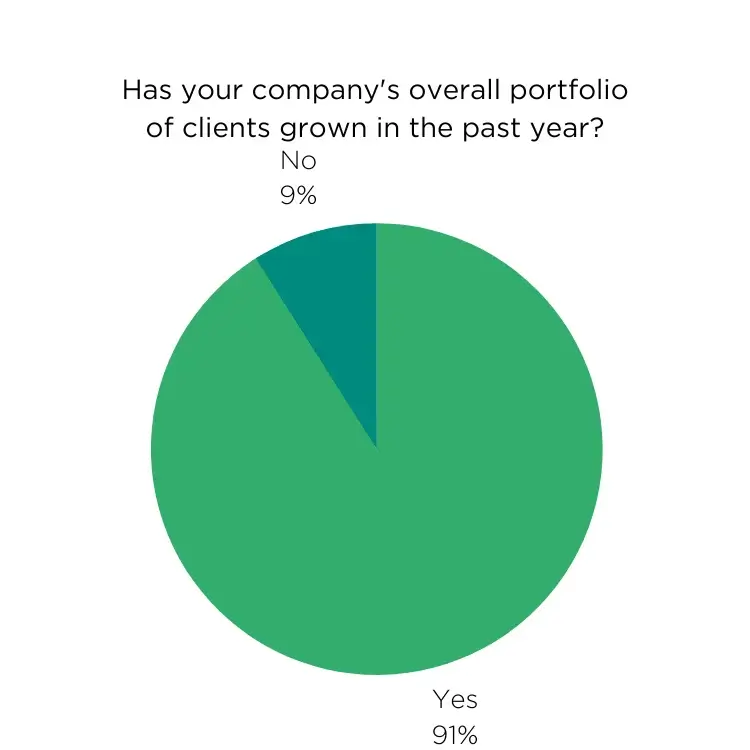

Even through 91 percent of executives experienced client growth in 2022, 61 percent also experienced client turnover. This high churn falls in line with the lack of overall dissatisfaction board members have towards their management companies.

At the end of the day, there are only so many associations available within a residential area for a management company to pursue. If a large number fire a management company, portfolio growth soon becomes impossible.

Key Takeaways

Some of the important takeaways for management companies:

Invest in the Homeowner

From homeowner education to mobile tools that provide self-service solutions, focusing on the homeowner will solve a multitude of problems for the management company. If homeowners are better educated on the capabilities of their associations, they will likely be more engaged. This increased engagement will help more associations achieve quorum and make meaningful impact. If homeowners and board members are also able to manage the bulk of their needs on their own, community managers are relieved of added time and stress and association members will feel more empowered. It’s a win-win-win for all.

Retention is Growth

Keeping current clients engaged is critical to a management company’s bottom line, just as much as portfolio growth. Improving communication and transparency and re-engaging boards with new tools that will streamline efficiencies is extremely important to profit growth. Executives should review the tools and technologies they have that can re-engage their current clients and better support their growth strategies.

Thank You.

We owe a heartfelt thank you to all of the boards, managers, management companies and industry professionals who contributed to this survey. Your candid responses made it possible for us to present this information to you. At CINC Systems, our mission is to make living in a professionally managed community a great experience. The 2023 State of the Industry Results prove that our focus on the homeowner will drive continued success for our clients, and we will continue to innovate our solutions to elevate the homeowner experience.

Keep an eye out next year for the State of the Industry survey so we can continue to track progress over time.

Feedback

We welcome your feedback! Is there something you wish we had included that you would like to see next year? Please let us know at marketing@cincsystems.com.