Giddy Up for Growth: CINC Up 2025 Heads to Austin

Read

Turning Hours Into Impact: How The NABO Group Uses Cephai+ to Scale Smarter

Read

Bye, Budget Burnout: CINC’s AI-Powered Budget Agent is Changing the Game for CAMs

Read

Snail Mail, But Smarter: CINC Partners with HOA Mailers

Read

From ‘Dewitt’ to Done: Inside DOME’s AI-Powered CAM Ops Evolution

Read

4 Reasons You’ll Love CINC’s New-and-Improved Community Portal

Read

Homeowner Data at Risk: The Alarming Cybersecurity Gap in CAM Operations

Read

AI for CAMs: Separating Signal from Noise in an Age of AI Overload

Read

Make Pool Season Chill: How CINC Is Taking the Heat Off Community Managers

Read

Why HOAs Need a Culture of Transparency, With or Without New Laws

Read

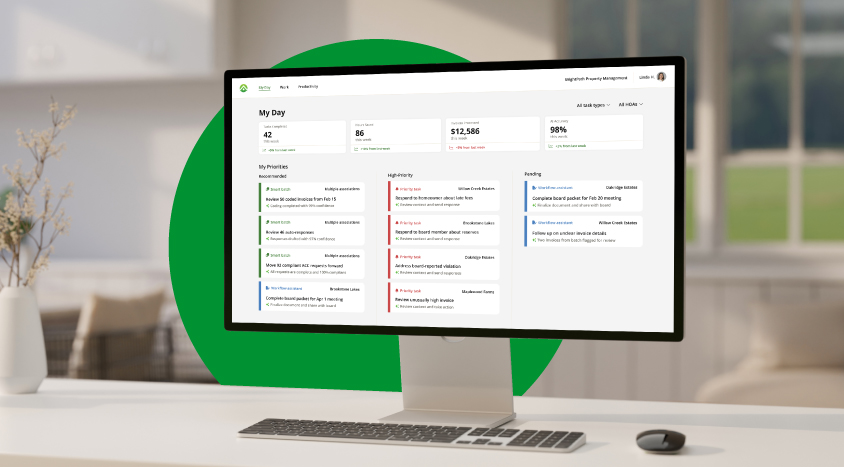

The Future of CAM Technology: Why CINC Leads the Pack in HOA AI Solutions

Read

Scaling With Soul: RISE Management Group Reimagines Growth Using AI

Read