Reduce manual and labor-intensive accounting processes.

Gain real-time visibility into your financials with a secure, robust accounting software designed for association management.

Payables+

Faster, easier, and more secure vendor payments

Payables+ combines AI invoice processing with electronic payments through AvidXchange. It eliminates manual invoice entry, coding, and check processing so your team can focus on what matters most.

-

Automates invoice processing and vendor payments in one platform

-

Faster vendor payments with ePayments

-

Reduces costs and increases profitability with the industry’s best revenue share model

-

Protects sensitive financial data with industry-leading security

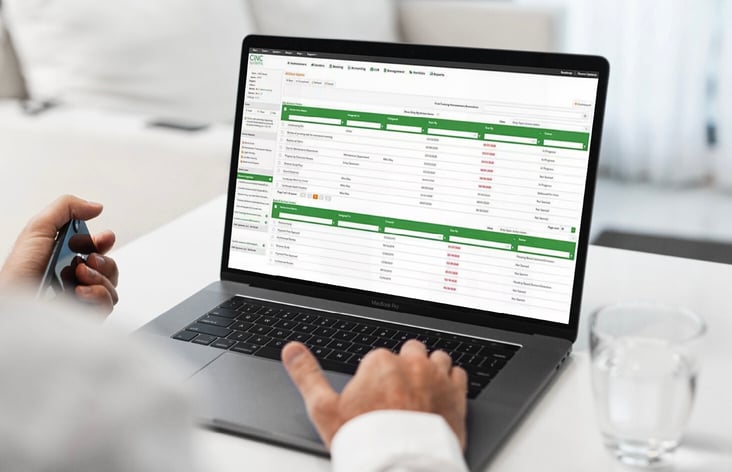

Receivables

Flexible accounts receivable management with subledger tools

Experience precision and power with CINC’s Subledger Tools. Enjoy the flexibility of tracking specific assessments on separate homeowner ledgers instead of the regular assessments.

- Seamless payment management

- Subledger fund separation

- Effortless Florida law compliance

Banking Integrations

Seamless banking connections with trusted partners

CINC’s network of 40+ banks lets you work with your preferred financial institution while streamlining transactions, automating reconciliations, and reducing errors for greater efficiency and transparency.

- Bank with preferred software

- Save time & work faster

- Reduce errors & payment delays

Reporting & Analytics

Comprehensive financial reporting at your fingertips

Streamline financial reporting, enhance visibility, and stay informed with one-click reporting. Generate multiple reports for multiple associations.

- PDF bank statements & reports

- Easy month-end reporting

- Clear, actionable insights

- Create multiple custom financial packages

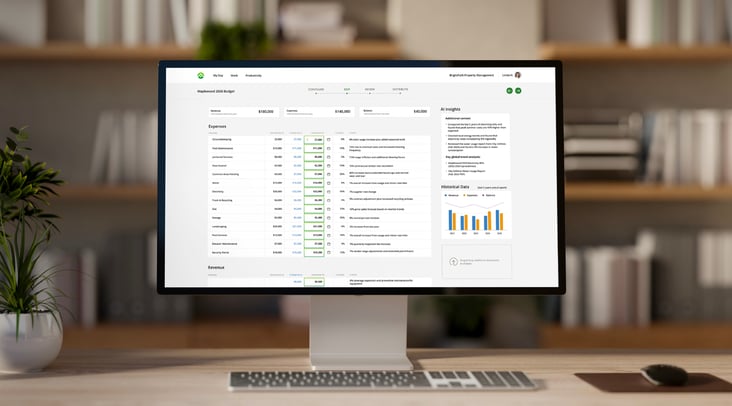

Budgeting

Streamlined budget management for financial clarity

CINC’s Budget Module makes it easy to create, manage, and adjust your association’s budget—all within one integrated platform. With forecasting tools, customizable options, and the ability to compare multiple budget versions, you can make confident, data-driven decisions without ever leaving CINC.

Plan and manage your budget directly in CINC—no spreadsheets needed.

Override distribution methods for any line item with complete flexibility.

Have and compare multiple budget versions to explore financial scenarios.

Corporate Accounting

Cloud-based accounting for real-time visibility and simplified workflows

CINC centralizes all your corporate accounting tasks in the cloud, giving your team instant access to real-time financial data and tools—all from a single, user-friendly platform. Improve communication with boards and homeowners, boost transparency, and streamline accounting like never before.

- Custom alerts & auto reconciliation

- One login, one screen

- Real-time data for financial transparency

Accounting Services

Let us take care of your numbers so you can focus on your business

Hiring and managing an accounting team is costly and time-consuming. Our experts handle your accounts receivable, accounts payable, and financial management.

- Accounts receivable: fee setup, payments, ownership transfers

- Accounts payable: invoice processing, refunds, payroll entries

- Financial management: daily reconciliations, budget maintenance, reporting

See it in action

See how we’re shaping a future where communities connect and thrive.

Frequently asked questions

Online accounting software like CINC streamlines financial management by automating invoicing, dues collection, and reporting. It eliminates manual errors, ensures real-time financial visibility, and simplifies compliance with HOA regulations. Plus, cloud-based access allows accounting teams to manage finances securely from anywhere.

CINC Accounting gives association managers real-time access to financial data, automated reporting tools, and seamless banking integrations. With features like budget tracking, delinquency management, and invoice approvals, managers can make informed financial decisions without waiting on manual reports from accounting teams.

CINC employs advanced security measures, including bank-level encryption, multi-factor authentication, and automated backups, to protect financial data. Role-based access controls ensure only authorized users can view or modify sensitive information, keeping HOA financials secure and compliant.

CINC offers HOA boards automated accounting, real-time budget tracking, and seamless integration with banking partners to simplify financial management. Board members can easily review financial reports, approve invoices, and manage expenses from a single, user-friendly platform, which will ensure transparency and efficiency.

Yes, CINC provides board members with 24/7 access to financial statements, delinquency reports, budget summaries, and other key documents. Board members can review real-time data through a secure portal and make informed decisions from anywhere.

Yes, CINC’s invoice approval system maintains a complete audit trail of approvals. Board members can see who reviewed and approved invoices at each stage, ensuring accountability and compliance with HOA financial policies.

Banking integration allows HOA and management company financial systems to connect directly with banks for seamless transaction processing. With CINC’s banking integration, payments, deposits, reconciliations, and financial reporting are automated, reducing manual data entry and improving accuracy.

An API (Application Programming Interface) enables real-time, automated data exchange between CINC and banking institutions, ensuring up-to-date financial information. Secure File Transfer (SFTP) is another method that securely transmits banking data in batch processes, ensuring safe and reliable financial transactions while maintaining compliance with security protocols.

CINC’s bank integrations simplify financial operations by automating deposits, payments, and reconciliations. This reduces errors, improves cash flow visibility, and ensures compliance with banking regulations. With direct connectivity, accounting teams can process transactions faster and eliminate time-consuming manual work.

CINC’s reporting and analytics provide real-time financial insights, automated report generation, and customizable dashboards, allowing community managers and board members to make data-driven decisions. With easy access to budget tracking, delinquency reports, and financial statements, teams can streamline operations, improve transparency, and reduce manual reporting efforts.

The Aggregator Program consolidates financial data across multiple associations, giving management companies a high-level view of performance trends. This helps streamline reporting, improve forecasting, and identify financial risks before they become issues. By automating data collection and analysis, the Aggregator Program saves time and enhances strategic decision-making.