No Need For Filing Cabinets: 4 Ways CINC Makes Accounting Easier

Now that many of us are working from home, we are quickly adjusting the feng shui in our new office space. For many accountants, this means a cumbersome shopping spree for filing cabinets and the dread of trying to find space for all that paperwork with a small space. For accounting teams using CINC, the office space will look so clean that it would spark joy for Marie Kondo herself.

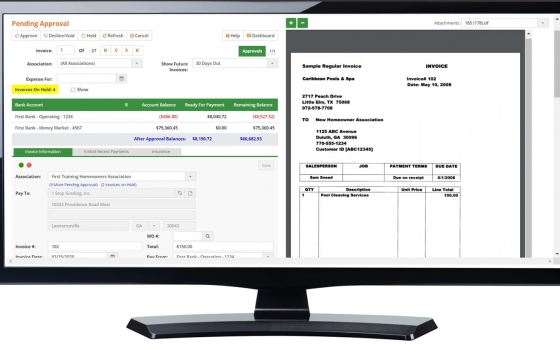

How is this possible? CINC is a completely cloud-based platform that maintains the history of all transactions and their sources. From check images and bank statements, to invoices and reports, everything is accessible to CINC users electronically. Bye-bye filing cabinets and papercuts, we are saving trees and hands at CINC.

CINC is proud to have a product suite that enables management companies to deliver month-end reports to their association boards within the first week of the month, on average. How, exactly, is this possible because of our product? To answer the specifics behind such a quick turn-around of financials, we talked to the team who serve as the resident experts of all things accounting: Accounting Services at CINC.

Accounting Services is a department within CINC Systems that provides full-cycle accounting for CINC clients who have chosen to outsource this aspect of community association management. The nine-person team currently manages the financials of about 800 associations comprising of about 45,000 doors. Olga Ridgeway is the Director of the team, leading eight experts who are able to deliver month-end reports within five business days for each of their clients.

Whether you use Accounting Services or have your own accounting team, the CINC way will make your day-to-day better than ever. Here’s a rundown of four reasons why CINC’s platform greatly improves efficiency and accuracy when it comes to accounting.

Daily Bank Reconciliation

CINC’s accounting platform has the ability to reconcile bank transactions on a daily basis in under a minute – all you have to do is click the button (seriously!) “I provide the accounting for about 150 associations in our portfolio,” explains Senior Accountant Steve Owens. “I can reconcile all of their bank accounts within two seconds. I can also identify any bank transaction discrepancies within 15-20 minutes.” By completing daily reconciliation accountants don’t have to spend the end of the month looking up multiple discrepancies all at once. “Prior to CINC I worked at a bank, where we had to wait for statements to come in at month-end to complete the reconciliation,” shares Senior Accountant Jennifer Thrasher. “Not only did this make the month-end such a stressful time, it was impossible to keep the bank accounts in balance throughout the month.”

Fraud Prevention

Because bank transactions are available and reconciled on a daily basis, fraudulent activity can also be discovered almost immediately. “A big ‘wow’ moment for me was when I had a client whose transactions I was reconciling from the previous day,” explains Thrasher. “Thanks to the bank transactions being received on a daily basis, I was able to identify a counterfeit check that an association received from a landscaper. I notified the client and the issue was resolved within a few days. Without CINC, it might not have realized until month-end. This could have been a huge loss and money out of pocket for the association.”

Transaction-Based Methods

Many accountants are used to journal entries as a means of recording transactions. The manual process of having to review invoices after they are posted and process journal entries to make any changes is standard. However, with CINC, all accounting is transaction-based, which means that journal entries are automatically created with each transaction. “This can be a bit of a shock to accountants when they first onboard with CINC,” Thrasher says. “We are all used to living and breathing in the world of journal entries, so clients tend to be stunned when they see it all done for them behind the scenes.” This automated approach to record-keeping also helps improve accuracy and speed when expenses need to be re-classified. “If I have to, let’s say, re-code an expense from water to electricity, all I have to do is go to the invoice record, change the GL, click save and it’s done. The system does everything else behind the scenes to reverse how the invoice was originally posted and post it correctly, while keeping an audit trail in the GL account history and on the invoice record.” The same automation applies for accounts receivable, when a homeowner payment is received, it is credited to the homeowner account, deposited into the bank and the corresponding general ledger entries are created.

Invoice and Report Functionality

In CINC, it is very easy to view a general ledger entries and their source, simply by clicking on the hyperlink and going directly to the invoice record with image. This helps to greatly improve the audit trail as well as drilling down from the general ledger to its origination for review purposes.

“You can also generate reports in multiple formats, such as Excel or PDF,” Owens explains.” Being able to extract data in excel can help with accounting calculations for budgeting and forecasting as well as trend analysis.

CINC is an efficient and robust accounting system that will get rid of your filing cabinets and improve the speed of delivery for your month-end financials. Providing a service that is one-of-a-kind to your HOAs will support you in your acquisition and retention goals. Contact us now if you’d like to see everything in action!