Table of Contents

Introduction

What's Inside

The State of the Industry Report is an exclusive look inside the thriving, but niche, community association management industry, analyzing the current attitudes, challenges, and trends currently shaping it. Our goal is to provide valuable insights and ideas to industry professionals as they navigate a changing market, and to guide the evolution of our own products and services as we seek to provide the most value to our customers.

About CINC Systems

We are the largest provider of software in the association management industry and the innovator behind accounting and banking integration. Founded in 2005 by a banker as the industry’s first SaaS offering, CINC Systems now employs over 200 people with customers throughout the country. CINC provides accounting and management software to over 30,000 associations around the United States, touching over 4 million homeowners. Our mission is to make living in a professionally managed community a great experience.

Dear Reader,

In one of his first interviews as CEO of Apple, with no shortage of PR and manufacturing crises to contend with, Tim Cook famously said, “You can focus on things that are barriers or you can focus on scaling the wall or redefining the problem.” I think this is the perfect way to describe our industry’s state of affairs in 2024.

It’s true there are plenty of factors threatening growth and success, from skyrocketing insurance costs to high employee turnover and cost-conscious boards. This pressure cooker environment has ushered in a reckoning and the need to pivot from “business as usual.” The most successful and sustainable companies will embrace transformation, turning challenges into growth opportunities.

Last year, we challenged the industry to Rethink Community. Now is the time to redefine our role within communities, from the way we do business to the value (i.e., leadership) we can provide during a time of rapid change. With our latest State of the Industry Report, our goal is not only to inform, but to empower.

At CINC Systems, we’re ready to Redefine Community. Are you?

Sincerely,

Ryan Davis

CEO, CINC Systems

Methodology

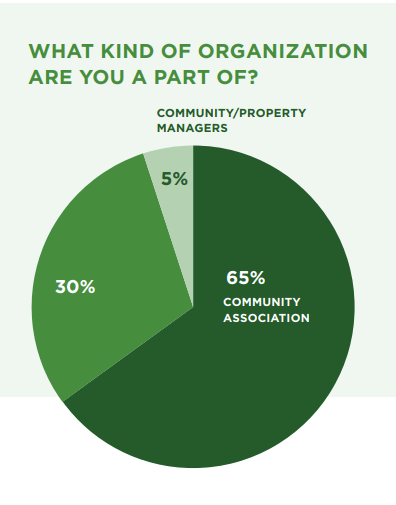

The analysis in our 2024 State of the Industry Report is based on a December 2023 survey of 222 association management industry professionals.

The survey was open and distributed to the industry at large. From members of highly reputable institutions to members of social media groups, anyone with involvement in a professionally managed community was invited to participate.

The majority of respondents were management company leaders, followed by community associations and management company service providers. An outsized number were located in the West Coast and Southeast.

We asked every respondent to answer the same question: “What is the biggest issue facing the community association industry?” Then, participants were given questions specific to their role.

Who We Surveyed

- Community Associations: Board members and individual managers (on-site or executive managers) NOT employed at management companies.

- Management Companies: Association management company executives and other employees who are not community/property managers.

- Community/Property Managers: Because of their outsized role in client satisfaction and retention, this group received a separate set of questions.

- Industry Vendors/Other: Respondents who did not fit into the community association/management company structure were asked general industry questions only.

Industry Pulse

What are the biggest threats facing community associations today?

When we asked industry professionals to rank their top concerns, the responses in 2024 versus prior years were notably different. Across all survey respondents, the top perceived threat was deferred maintenance; this concern outranked homeowner apathy, the #1 perceived threat in 2022 and 2023.

Community Associations

- HOA/COA Education

- Deferred Maintenance

- Homeowner Engagement

- HOA/COA Relations/Recruitment

Management Companies

- Deferred Maintenance

- HOA/COA Board Education

- Delinquency

- Underfunded Reserves

Why is deferred maintenance top of mind?

As COVID-19 forces people to spend more time at home and in their neighborhoods, they increasingly notice issues that need attention.

The Surfside condo collapse drives urgency in addressing deferred maintenance; new HOA/COA regulations and legislation ensue.

Inflation drives up labor and material costs; HOAs/COAs face pressure to either raise dues or risk the consequences of deferred maintenance.

But the answer varied across management companies, boards, and industry professionals. HOA/COA board education, board relations, and homeowner engagement were the top threats listed by community associations, while management companies showed more concern with delinquency, underfunded reserves, and economic fluctuation.

Natural disasters, short-term rentals, and outside investors are now seen as less of a threat than in years past.

Are community associations equipped to handle the challenges of today and tomorrow?

While different segments had different takes on the most pressing threats, associations and management companies are well aware of the many challenges before them. Do they feel prepared to face them? To find out, we asked associations about reserve funding and emergency preparedness.

Generally, associations have been diligent about commissioning reserve studies; most respondents (65%) said they’d completed a study within the past 3 years. Most (70%) also said their association regularly contributes to reserves.

But while associations are fairly proactive about saving for the unexpected, they feel far less confident about their ability to navigate unforeseen events. Only about 10% of associations planned to revisit their emergency preparedness plans in the next 12 months.

Citing a lack of education as the top threat, boards suggested they felt unqualified to make informed decisions for their community. Some management companies also expressed concern around board qualifications, motives, or engagement, underscoring the need to educate and empower board members.

.webp)

What's On Our Radar

Rising insurance premiums continue to strain on HOA communities, with condo associations experiencing the most significant jump in fees. The problem is particularly acute in states like Florida, where many insurers are pulling out due to population growth, climate change, and increased claims.

Recent legislation will shake up processes and requirements for HOAs and management companies.

AI technology is becoming increasingly mainstream, with plenty of applications in the CAM space (including CINC’s generative AI tool for homeowners, launched in 2023). But while AI can boost efficiency and the bottom line, it can also threaten security by giving bad actors more sophisticated tools. To protect sensitive homeowner data, companies should carefully vet partners leveraging AI technology.

Federal: As of January 1st, associations will be subject to new reporting requirements under the Federal Corporate Transparency Act, which will increase administrative costs.

Florida: SB 4-D created new inspection and reserve fund requirements for condominium and co-op buildings three or more stories tall.

Texas: House Bill 614 requires associations to detail the types of rules they have and the fine schedule for violations.

North Carolina: House Bill 311 created a special committee to review planned communities and condo associations the laws governing them. Its final report is due by March 1, 2024.

Maryland: House Bill 107 requires that community associations conduct a Reserve Study (and update that Reserve Study every five years).

Part 1: Redefining Risk

Strengthening Community Foundations

Homeowners contribute dues into their HOAs and COAs in hopes of increasing return on investment. Deferred maintenance, the largest perceived threat in the industry, drags down property values and poses safety concerns. The longer updates and repairs are postponed, the more risky and costly they become; yet, addressing deferred maintenance can prove extremely challenging.

Many homeowners, whose budgets are increasingly squeezed by inflation, are hesitant to approve due increases. Even well-intentioned board members often lack the construction, finance, and management experience needed to not only make strategically-sound decisions, but rally homeowners behind them. And while management companies are obligated to inform and educate the board when deferred maintenance threatens the health of the community, competing priorities make it difficult for stretched-thin managers to fight unpopular battles.

Promoting Communication & Compromise

The good news is that this year’s study showed associations being relatively proactive about savings and reserve studies. So, how can boards connect the dots between awareness and action — and how can management companies help? It starts with thoughtful action plans and effective communication.

1. Understand Needs & Priorities. After an assessment is completed, management companies can make growing to-do lists feel less overwhelming to boards and homeowners by breaking down and prioritizing projects.

2. Develop Action Plans. Helping boards and homeowners understand logistics like timelines, finances, point persons, and potential short-term impacts to the community promotes transparency and trust.

3. Gain Consensus. Homeowners have a common interest in promoting safe, thriving communities. The more homeowner engagement boards and management companies can achieve, the better the chances of overcoming inertia and pushback.

Ask CINC: What if the board won’t budge?

In a perfect world, HOA board members would aside ego and self-interest. But it’s not a perfect world, and sometimes, anti-spend boards refuse to be part of solutions that are in their community’s best interest. As maintenance issues go unresolved, threatening safety, quality of life, and home values, finger pointing intensifies and client satisfaction suffers.

If this sounds familiar, you’re not alone; despite 75% of management companies saying their portfolio grew in the past year, 60% of management companies also said they’d experienced client churn. But client turnover wasn’t always considered a negative. Said one survey respondent:

“We had some very long term managers leave as a result of updating processes and their clients followed them. We don’t view this as a serious concern as the clients that left were paying way under market value and were unwilling to embrace new ways of doing things, so the churn is actually giving us the opportunity to find clients more aligned with our practices.”

Removing clients who are difficult, unprofitable, or stuck in their old ways can be a necessary and natural part of a management company’s growth journey.

Communication Methods Matter

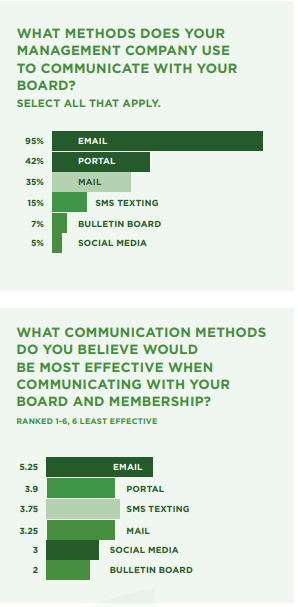

Communication is essential to the health of managed communities and the working relationships between boards and management companies. Yet, there’s a disconnect between the communication channels deemed most effective and the methods used most by management companies.

On a scale of 1-5, our survey respondents ranked their satisfaction with their management company’s communications at a 2.5.

36% of community associations said they are not satisfied with their management company. Poor communication is among the top reasons.

“They need to keep the whole community better informed of the status of projects, goings on and financial matters. The quarterly newsletter has degenerated into routine scoldings about pet waste and garbage bins.”

“You’re not offering monthly meetings face to face. You’re only communicating via email which leads to very long conversations about simple problems and is very frustrating.”

By diversifying communication channels, boards and management companies are likely to reach more homeowners, increase engagement, and improve client satisfaction.

Part II: Redefining Roles

Empowering Collaborative Communities

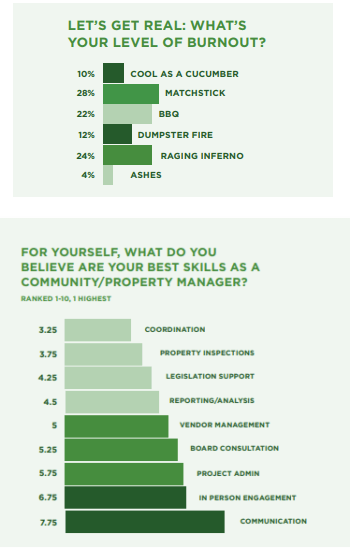

The significance of the community manager’s role cannot be overstated, as it is the linchpin for client growth, client churn, customer service, and profitability. As burnout, employee turnover, and recruitment issues continue to plague the industry, it’s time to take a hard look at the causes as well as solutions. Let’s start with what the managers in our survey had to say.

Employee turnover was named as the second-biggest threat by management companies, followed by challenges in recruiting managerial talent.

Managers recognize that it’s increasingly difficult to provide the level of service needed to optimize client satisfaction and reduce turnover. When asked what’s holding them back in their career, the top reasons cited were not enough time and increasing portfolio sizes — two closely related challenges.

So, how can management company executives best support managers in order to address burnout? There’s a disconnect between what managers say they need and what executives think they need.

How Management Companies are Supporting Managers

- Paying for Certifications

- Offering Remote Work

- Increasing Salaries

What Managers

Say They Need

- Better Homeowner Education

- Self-Service Tools for Homeowners

- Certifications

It appears that reducing burnout and improving employee retention aren’t going to be solved by simply throwing money at the problem — e.g., increasing salaries or certification opportunities. Rather, there is an opportunity to redefine the role of the manager altogether so it is more closely aligned with managers’ skills and needs, as well as the needs of their clients.

Mundane to the Meaningful:

Reframing the Manager’s Role

Managers rank communication, face-to-face engagement, and project administration among their strongest skill sets. While allowing managers to flex their higher-level talents would no doubt boost morale, managers say a lack of time is holding them back.

Technology can automate simple, routine tasks, such as responding to homeowner questions, driving efficiency and job satisfaction. In the longer term, automation also boosts client satisfaction by improving response times and freeing managers to focus on more important tasks.

Associations and managers agree: more education is needed. What role do CAM companies play?

It’s clear that HOA/COA board education is crucial to the role of the manager. The more educational tools that the board has, the better the manager will be able to engage with those boards and achieve overall community goals.

A few places to start:

- Onboarding for New Board Members. Clearly define roles and responsibilities, brief board members on financials and local HOA laws, and provide conflict resolution training. Welcome packets can include handbooks, vendor contacts, directories, and other community documents.

- Make Documents Easily Accessible. Governing documents should be easy for the board to access online; better yet, consider a tool like CINC’s generative AI technology, which answers questions in seconds.

- Provide First-Hand Learning. Allow new board members to observe tasks like site inspections and maintenance projects and introduce them to vendors. Consider assigning mentors — previous board members with historical knowledge who can help new members get up-to-speed.

- Ask for Feedback. The best way to gauge what associations need is to ask. Be sure you’re regularly surveying your boards and facilitating two-way conversations.

Part III: Redefining Revenue

Thinking Outside the Management Fee

Many small to medium-sized management companies struggle with profitability as competition from larger firms challenges their management fee structure. Between cost-conscious boards, low bidders dragging down management fees, and soaring costs, improving efficiency and thinking outside the box will be key in the coming years. If one thing is clear, it’s that the all-inclusive, fee-only structure can no longer sustain growth.

70% of CAM executives believe that finding new revenue opportunities outside of management fees in the next 3-5 years is critical.

How are management companies creating new revenue streams?

70%

are offering resale packages

50%

charge overage fees such as Schedule A’s

48%

monetize bank partner relationships

38%

generate a revenue share on third party services

It’s increasingly common for management companies to charge extra for services like resale packages, incorporate additional fees into their contracts, monetize bank partner relationships, or enter revenue share arrangements with third-party service providers like AP payments. But it’s important to note that, of the survey respondents who are uncovering new ways to generate revenue, over 80% of those who are going beyond resale packages have over 5,000 doors in their portfolio. This suggests that smaller sized management companies aren’t taking advantage of revenue opportunities as much as larger, more mature organizations.

80% of CAM companies diversifying revenue streams beyond resale packages have 5,000+ doors in their portfolios.

Examples of Services Outside the Base Management Fee:

- Loan Administration

- Managing New, Major Projects

- Handling Large Insurance Claims

Small to midsize management companies have a distinct opportunity to draw inspiration from larger firms who are diversifying their revenue streams beyond management fees or resale packages. Leveraging technology, automation, or outsourcing can help them cost-effectively handle the predictable, ongoing tasks included in their base management fee. In addition, automated technology should help organizations of any size uncover revenue that may not be easy to recognize in a manual billing process.

Prediction: Communities will start running more like businesses.

- To maintain their communities without depleting reserves (or raising dues beyond what homeowners can stomach), more HOA boards will start to find new revenue streams by monetizing their unique access to residents through exclusive agreements with service providers.

- Management companies will increasingly use innovative strategies like group insurance to decrease rates, or even find better rates through partnerships as a selling point to get boards to switch to their management company.

- Management companies will deploy more sophisticated analytical measures to gauge success and customer satisfaction, such as customer surveys and Net Promoter Score (NPS). Metrics like customer retention, positive service interactions, and referral rates will give companies a more complete picture of success beyond P&Ls.

Catapulting Growth through Mobile Innovation

Spectrum Association Management’s Journey

With more than 200,000 units in its portfolio, Spectrum Association Management is incredibly successful and continuing to grow. This longtime CINC customer was an early adopter of digital homeowner tools, launching its app in 2020. It was wildly successful in driving homeowner engagement and Spectrum’s bottom line.

Check out our case studies to learn how CINC Systems’ self-service tools helped Spectrum stand out from the competition, earn new business, and solidify its status as one of the most profitable companies in the industry.

CINC's Influence

66%

app adoption among Spectrum homeowners

39%

of homeowner payments in the app

12%

reduction in contact volume

97%

of Spectrum clients renew year over year

Take Home Points

- Associations are fairly proactive about saving for the unexpected, but feel far less confident about their ability to navigate unforeseen events.

- Management companies who help educate boards and provide thoughtful, actionable plans will be of great value.

- Poor communication is among the top reasons for management company dissatisfaction. Diversifying communication channels allows boards and management companies to reach more homeowners, increase engagement, and improve satisfaction.

- Manager burnout and turnover remains a top industry concern, and companies have an opportunity to redefine the role of the manager to align with managers’ skills and client needs. Technology and automation can improve responsiveness and free managers to focus on more important tasks, like board education.

- As small to medium-sized management companies currently struggle with profitability, it’s clear the all-inclusive, fee-only structure is no longer sustainable. It’s increasingly common for large management companies to charge extra for services outside the base management fee, like loan administration, and smaller companies should follow suit.

Thank You.

We owe a heartfelt thank you to all the boards, managers, management companies and industry professionals who contributed to this survey. Your candid responses made it possible for us to present this information to you. At CINC Systems, our mission is to make living in a professionally managed community a great experience. The 2024 State of the Industry Results prove that our focus on the homeowner will drive continued success for our clients, and we will continue to innovate our solutions to elevate the homeowner experience.

Keep an eye out next year for the State of the Industry survey so we can continue to track progress over time.

Feedback

We welcome your feedback! Is there something you wish we had included that you would like to see next year? Please let us know at marketing@cincsystems.com.